Decentralized Finance (DeFi): The

Future of Banking?

In current years, one of the most groundbreaking traits in

the world of finance has been the emergence of Decentralized Finance (DeFi).

Often hailed due to the fact the future of banking, DeFi has the capability to

transform conventional monetary systems, providing a decentralized, open, and

borderless financial surroundings powered with the resource of blockchain

generation. But what precisely is DeFi, how does it art work, and will it

truely update the conventional banking system?

This whole manual will discover the crucial standards of

DeFi, its blessings and demanding situations, key applications, and its

capability to reshape the future of finance.

What is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) refers to a trendy financial

gadget constructed on decentralized blockchain networks, more frequently than

no longer Ethereum. Unlike conventional finance, which is predicated on

centralized establishments like banks, exchanges, and brokerages, DeFi operates

without intermediaries. It allows clients to perform financial sports inclusive

of lending, borrowing, shopping for and promoting, and investing at once thru

decentralized protocols.

At its middle, DeFi is powered by using smart

contracts—self-executing contracts with the terms of the agreement at once

written into strains of code. These contracts run on blockchain networks,

permitting transparency, safety, and trustless transactions. This device is

available to all people with an internet connection, making it a international

economic environment that transcends borders.

Key Components of DeFi:

·

Blockchain Technology: DeFi applications

(additionally called dApps) are built on blockchain structures, mostly

Ethereum. The decentralized nature of blockchain ensures that no unmarried

entity controls the system, making sure transparency and safety.

·

Smart Contracts: These are the backbone of DeFi.

Smart contracts automate and put into effect agreements among events without

the need for an middleman. After pleasing the contractual conditions, the

transaction is finished mechanically.

·

Tokens and cryptocurrencies: DeFi makes use of

cryptocurrencies (like Ether, the original currency of Ethereum) and other

digital tokens to facilitate transactions and services. Tokens regularly

constitute belongings, commodities or stocks and can be traded or used in

diverse DeFi programs.

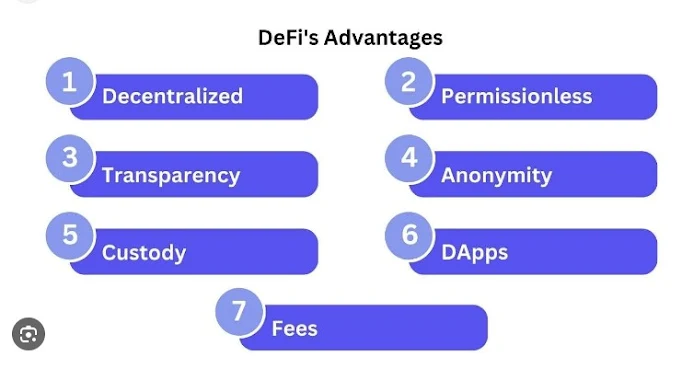

Advantages of DeFi

DeFi has captured attention due to the numerous blessings it

brings over the conventional banking machine. Below are some of the maximum

compelling advantages:

·

Accessibility and Inclusivity

Traditional monetary systems are frequently inaccessible to

hundreds of thousands of people, particularly in underdeveloped regions in

which banking infrastructure is lacking. DeFi allows truly anybody with an

internet connection to get entry to monetary offerings without the need for

identification, credit records, or maybe a monetary group account. This ought

to potentially deliver billions of unbanked people get right of entry to to the

financial environment.

·

Transparency

DeFi operates on public blockchain networks, which means all

transactions are recorded on a decentralized ledger visible to every person.

This excessive stage of transparency ensures duty, as transactions can be

audited, and the suggestions governing them are embedded in smart contracts.

·

Lower Costs

By putting off intermediaries which include banks, agents,

and exchanges, DeFi considerably reduces transaction fees and issuer costs. For

example, lending systems like Aave or Compound allow customers to lend or

borrow belongings at once without having to pay a economic organization or

economic company as an intermediary.

DeFi operates without crucial government, that means no

unmarried entity can manage, control, or restriction the device. This presents

customers with autonomy and control over their price range.

·

Borderless Transactions

Since DeFi operates at the internet, it removes the

boundaries related to pass-border transactions. With traditional banking,

global transactions regularly include hefty charges, delays, and complex

approaches. DeFi allows for near-instantaneous, low-charge cross-border

transactions, making it a surprisingly green gadget for worldwide change.

·

Innovation

The DeFi atmosphere is constantly evolving, with developers

constructing modern products and services that provide new possibilities for

customers. From decentralized exchanges (DEXs) to yield farming, the type of

available DeFi services is hastily increasing.

The decentralized nature of DeFi enables a huge variety of

monetary applications. Here are a number of the highlights:

·

Decentralized Exchanges (DEX)

Unlike centralized exchanges, DEXs like Unsnap and Sushi

Swap permit users to exchange cryptocurrencies without delay with each other

without the want for intermediaries. DEX gives more prolateness, decrease

expenses and reduced dangers related to centralized alternate hacks.

·

Borrowing and lending

DeFi structures together with Agave and Compound allow users

to lend their assets and earn hobby or borrow against their cryptocurrency

holdings. Interest fees are decided algorithmically based totally on deliver

and demand, and the complete technique is carried out using clever contracts.

·

Stable coins

One of the principle criticisms of cryptocurrencies is their

volatility. Stable coins like USDC, DAI, and USDT are pegged to traditional

assets like the US dollar and offer balance while maintaining the advantages of

blockchain-primarily based assets. These stable coins are widely utilized in

DeFi for buying and selling, lending and as a shop of fee.

·

Profitable farming and liquid mining

Revenue Management allows users to lend their

crypto-belongings in trade for hobby or rewards. Liquidity mining is going a step

similarly because it rewards users who offer liquidity to decentralized

protocols with additional tokens. This shape of incentivized liquidity

provision has end up a key driving force within the DeFi surroundings.

·

Insurance

DeFi is also disrupting the insurance enterprise with the

aid of providing decentralized coverage protocols. Platforms like Nexus Mutual

provide smart agreement insurance that permits customers to shield themselves

against risks inclusive of smart settlement failures, hacking, or alternate

insolvency.

·

Prediction markets

Decentralized prediction markets like Augur permit users to

wager at the outcome of real occasions inclusive of elections, sports or

commodity fees. These markets function without centralized manage and provide

members extra transparency and fairer odds than conventional betting platforms.

Challenges and dangers in DeFi

While DeFi has brilliant capacity, it isn't without

demanding situations and dangers:

·

Vulnerabilities of smart contracts

Smart contracts are handiest as secure because the code

they're written in. Bugs, vulnerabilities, or poorly written code can lead to

catastrophic screw ups or hacks. The notorious 2016 DAO hack that brought about

the robbery of tens of millions of dollars is a prime instance of the way

matters can move incorrect while vulnerabilities are exploited.

·

Regulatory uncertainty

DeFi operates in a relatively unregulated area that affords

each possibilities and risks. While lack of law encourages innovation, it additionally

opens the door to unlawful sports such as cash laundering and fraud.

Governments round the world are grappling with a way to adjust the DeFi area

without stifling its growth.

·

Liquidity dangers

DeFi remains in its infancy and liquidity can be a trouble

at times, specifically during marketplace downturns. In quite volatile

surroundings, liquidity vendors may additionally withdraw their assets, main to

rate slippage or illiquid markets.

·

Scalability troubles

Most DeFi applications are built on top of Ethereum, which

has struggled with full-size scalability problems. High network congestion

regularly results in gradual transaction instances and exorbitant costs, especially

in the course of intervals of excessive demand. Ethereum's transition to Ethereum

2. Zero, which ambitions to enhance scalability via Proof-of-Stake (PoS) and sharing,

may want to assist alleviate these issues.

·

User revel in and training

DeFi can be complicated and intimidating for brand new

users, requiring a positive level of technical expertise and expertise of

blockchain era. This steep getting to know curve can limit DeFi adoption,

particularly among much less tech-savvy people.

The Future of DeFi: Will It Replace

Traditional Banking?

As DeFi continues to evolve, many wonder if it has the

capability to update the conventional banking tool. While DeFi offers an

revolutionary opportunity, it can not completely replace traditional banking

inside the close to destiny. Instead, we may want to see a hybrid gadget in

which DeFi and traditional financial establishments coexist and supplement each

one of a kind.

·

Potential for Integration:

Traditional monetary institutions are already exploring

blockchain technology and decentralized systems. Major banks are looking into

providing cryptocurrency services, and crucial banks are experimenting with

Central Bank Digital Currencies (CBDCs), that can combine with DeFi protocols.

·

Regulation and Adoption:

For DeFi to reap mainstream adoption, regulatory readability

is important. Clear and balanced policies might assist defend customers from

fraud whilst fostering innovation. As governments begin to modify the distance,

institutional adoption of DeFi might also need to surge.

·

Impact on Global Financial Inclusion:

One of DeFi’s most promising elements is its capacity to

democratize get right of entry to financial offerings. By putting off the

constraints associated with conventional banking, DeFi should offer billions of

unbanked people get right of entry to international markets and economic

services, because of this riding financial boom in developing areas.

Conclusion

Decentralized finance (DeFi) is poised to exchange the way

we reflect on consideration on banking and financial services. By offering a

decentralized, transparent and accessible gadget, DeFi has the capability to

empower people and corporations around the arena. However, for DeFi to reach

its complete capacity, demanding situations together with smart settlement

security, regulatory uncertainty and scalability must be addressed.

Whether DeFi turns into the future of banking stays to be

seen, but its disruptive effect on the monetary industry is plain. As the gap

matures, it may reshape no longer only how we manipulate money, however also

how we perceive financial systems as an entire.

No comments:

Post a Comment